Trường Cao đẳng Y Khoa Phạm Ngọc Thạch TP.HCM tuyển sinh 2024

26 Tháng Ba, 2024

Trường Cao đẳng Y Dược Sài Gòn là trường công hay tư?

11 Tháng Ba, 2024

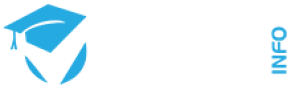

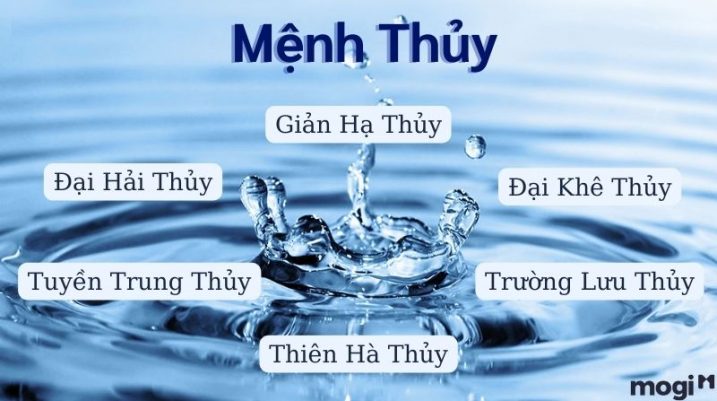

Mệnh Thủy sinh năm nào? Người mệnh Thủy có cuộc sống ra sao?

9 Tháng Một, 2024

Thiền để làm gì? Ý nghĩa của thiền trong cuộc sống

7 Tháng Tư, 2023

Hướng dẫn thiền biết ơn giúp cân bằng cảm xúc và mang lại may mắn

7 Tháng Tư, 2023

Trường Cao đẳng Y Khoa Phạm Ngọc Thạch TP.HCM tuyển sinh 2024

26 Tháng Ba, 2024

Trường Cao đẳng Y Dược Sài Gòn là trường công hay tư?

11 Tháng Ba, 2024

Mệnh Thủy sinh năm nào? Người mệnh Thủy có cuộc sống ra sao?

9 Tháng Một, 2024

Thiền để làm gì? Ý nghĩa của thiền trong cuộc sống

7 Tháng Tư, 2023

Trường Cao đẳng Y Khoa Phạm Ngọc Thạch TP.HCM tuyển sinh 2024

26 Tháng Ba, 2024

Trường Cao đẳng Y Dược Sài Gòn là trường công hay tư?

11 Tháng Ba, 2024

Mệnh Thủy sinh năm nào? Người mệnh Thủy có cuộc sống ra sao?

9 Tháng Một, 2024