Tìm hiểu mức học phí ngành Ngôn ngữ Nhật 2024

26 Tháng Tư, 2024

Danh sách các trường Cao đẳng học phí rẻ năm 2024

19 Tháng Tư, 2024

Trường Cao đẳng Y Khoa Phạm Ngọc Thạch TP.HCM tuyển sinh 2024

26 Tháng Ba, 2024

Trường Cao đẳng Y Dược Sài Gòn là trường công hay tư?

11 Tháng Ba, 2024

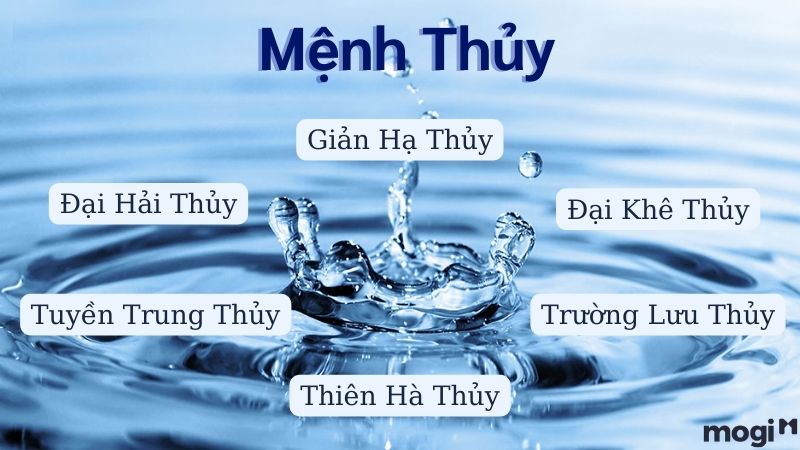

Mệnh Thủy sinh năm nào? Người mệnh Thủy có cuộc sống ra sao?

9 Tháng Một, 2024

Tìm hiểu mức học phí ngành Ngôn ngữ Nhật 2024

26 Tháng Tư, 2024

Danh sách các trường Cao đẳng học phí rẻ năm 2024

19 Tháng Tư, 2024

Trường Cao đẳng Y Khoa Phạm Ngọc Thạch TP.HCM tuyển sinh 2024

26 Tháng Ba, 2024

Trường Cao đẳng Y Dược Sài Gòn là trường công hay tư?

11 Tháng Ba, 2024

Tìm hiểu mức học phí ngành Ngôn ngữ Nhật 2024

26 Tháng Tư, 2024

Danh sách các trường Cao đẳng học phí rẻ năm 2024

19 Tháng Tư, 2024

Trường Cao đẳng Y Khoa Phạm Ngọc Thạch TP.HCM tuyển sinh 2024

26 Tháng Ba, 2024